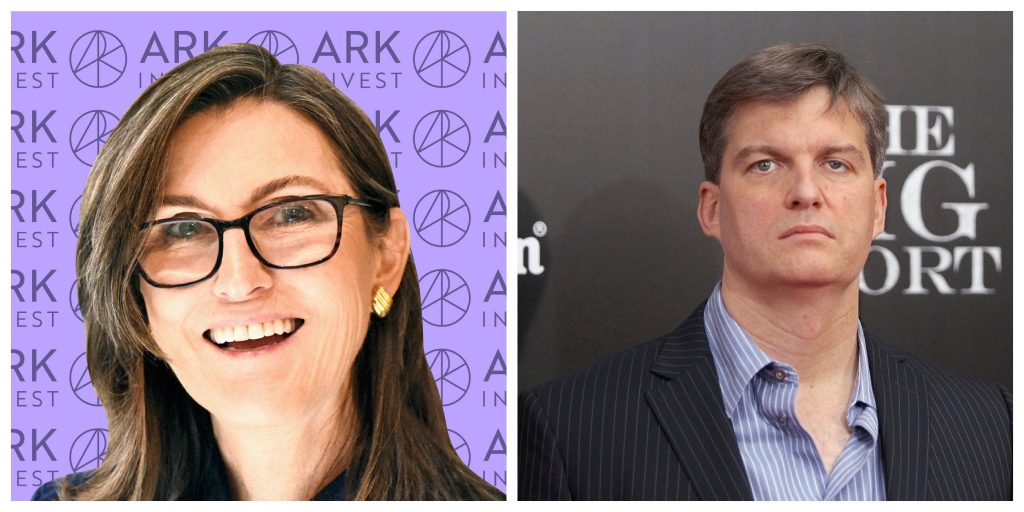

- Cathie Wood has responded to Michael Burry's new $31 million short bet against her Ark Invest innovation ETF.

- In a tweet thread on Tuesday, Wood made the case for another move higher in innovation stocks.

- "I do not believe that he understands the fundamentals that are creating explosive growth and investment opportunities in the innovation space," Wood said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Michael Burry's short bet in Ark Invest's Disruptive Innovation ETF has caught the eye of Cathie Wood, who responded in a tweet thread on Tuesday as to why Burry's bet is misguided.

A recent 13F filing from Burry's Scion Asset Management revealed a new $31 million put position in ARK Invest's flagship ETF, as well as a growing put position worth $731 million in Tesla, which remains Wood's highest conviction stock.

But according to Wood, Burry may not understand the current growth environment as inflationary pressures are likely to be short-term in nature.

"Most bears seem to believe that inflation will continue to accelerate, shortening investment time horizons and destroying valuations," Wood explained. But Wood thinks supply-chain related issues will be resolved, helping relieve inflationary pressures.

Wood pointed to a sharp drop in certain commodity prices in recent weeks, including lumber, copper, and oil, as to why inflation may not linger for as long as some think. Used-car prices are also beginning to fall after an extraordinary rise, and a strengthening US dollar has also put pressure on commodity prices, according to Wood.

Meanwhile, the bull market in stocks has broadened to other areas and sectors of the market like value, energy, and basic materials.

"The bull market has strengthened, setting the stage we believe for another leg up in innovation strategies," Wood said.

She continued: "In our view, the seeds for the innovation explosion that Ark Invest is dedicated to researching we planted during the 20 years ending with the tech and telecom bust. Having gestated for more than 20 years, these technologies should transform the world during the next 10 years,"

In a February tweet that's since been deleted, Burry said Wood's promises of disruptive growth and transformative technologies wouldn't be realized. "Shades of Gary Pilgrim and PBHG Growth from the 1990s, or Gerald Tsai and the Manhattan Fund in the 1960s," he tweeted.

Ark "is defining an era," Burry continued. "If you know your history, there is a pattern here that can help you. If you don't, you're doomed to repeat it."

But Wood is sticking to her strategy, and thinks while Burry struck big during the housing crash of 2008, that success might not be repeated this time around.

"To his credit, Michael Burry made a great call based on fundamentals and recognized the calamity brewing in the housing/mortgage market. I do not believe that he understands the fundamentals that are creating explosive growth and investment opportunities in the innovation space," Wood concluded.